Blog Categories

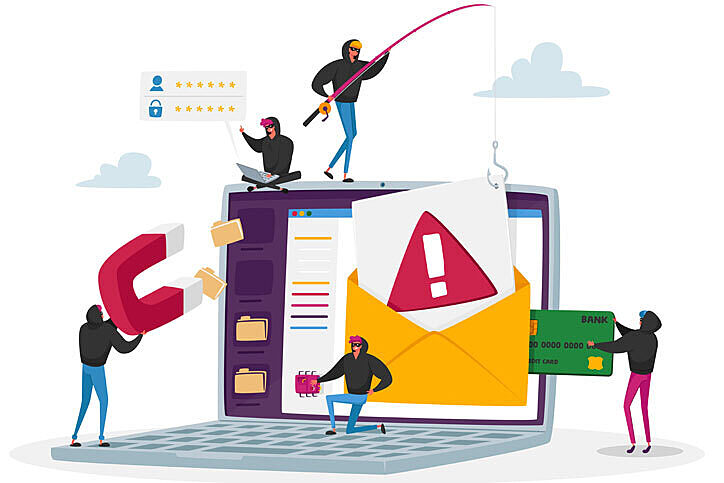

Stop the Scam!

Bad guys rely on social engineering – their goal is to trick you into giving them access to your money or convince you to willingly hand it over. The more they know about you, the easier it is for them to take advantage of you. Fortera does not want you to experience this! So here are some tips to help you identify a scam.

- If someone offers you a deal that is too good to be true, it is. Examples are being told you won a lottery you never entered, or being offered a reward to help someone move money, or you’re offered a work from home job you never applied for. These situations will always be scams.

- If someone sends you a check for more than you expected, they will ask you to deposit it and send them the overpayment electronically. You will soon find yourself responsible for depositing a bad check while the scammer enjoys spending the “overpayment” you gave them.

- If you have developed a close relationship online with someone you have never physically met in person, beware if they ask for money due to an emergency. About 98% of the time that will be a scam. If they tell you they are overseas, the chance of it being a scam increases to 99.9%.

- CashApp, Venmo, Zelle, Paypal, etc are safe ways to move money. But if someone emails or texts you those apps as a free download, their free app will always be malware and they will eventually get access to your accounts and steal from you. It is safe to download those apps from an app store or use them through a trusted provider, like your credit union.

- Verify all charities independently before you decide to donate. Many scammers pretend to represent charities just to get you to hand them your cash. When you donate directly to a charity through their official website, you can be certain the money is going where you expect it to.

There are also a few things you can do to keep your hard earned cash safe and protect your financial well- being.

- Make it a habit to monitor your accounts regularly.

Sign up for all free fraud alerts offered by Fortera Credit Union and the credit bureaus. - Never share your login names, passwords, account numbers, card numbers or PIN numbers with anyone. Those are the keys to your financial kingdom.

- Stop phishing attacks. Don’t open unwanted emails. Don’t answer phone calls from unknown numbers. Delete texts you receive from anyone that you don’t know.

- Don’t post personal information on-line.

If you know how to spot a scam and also take these recommended steps to protect yourself, you make it nearly impossible for a scammer to steal your money.