Overdraft Protection

Keep your finances running smoothly with these helpful tools.

Preventing Overdrafts 101

Accidentally overdrafting your account can happen to anyone. It can be frustrating, embarrassing, and occasionally, a total day-ruiner. But don't worry. We have plenty of tools that can help protect you from declined debit cards and keep your finances on track.

Account Alerts

A great way to stay informed is with account alerts. You choose what's important to you, and get notified via text or email. Examples of popular alerts include withdrawal notifications, low balance alerts, and daily balance notifications. You can also text us at 454545 to learn more about your accounts. For example, text us 'LAST' and we will share your last five transactions with you (as long as they fall within the previous 90 days).

You can easily set these notifications up in Online Banking by clicking My Settings in the top-right navigation, and scrolling to the bottom of the page until you see Alerts & Notifications.

To set up notifications in Mobile Banking, log in to your account, select More in the lower right-hand corner of your screen, and click the gear icon (this will take you to your settings menu). Select Push Notifications and enable all the ones you are interested in receiving. You can also click Quick Balance to view your daily balance on your smartphone or watch without needing to log in to your account.

Linking Your Savings Account to Your Checking Account

Another easy way to prevent overdrafts is to link your savings account (credit unions often refer to your savings account as a share account) to your checking account. Linking your checking account to your savings account means that when you accidentally overdraft, we take funds from your savings account to cover the accidental overspending in your checking account.

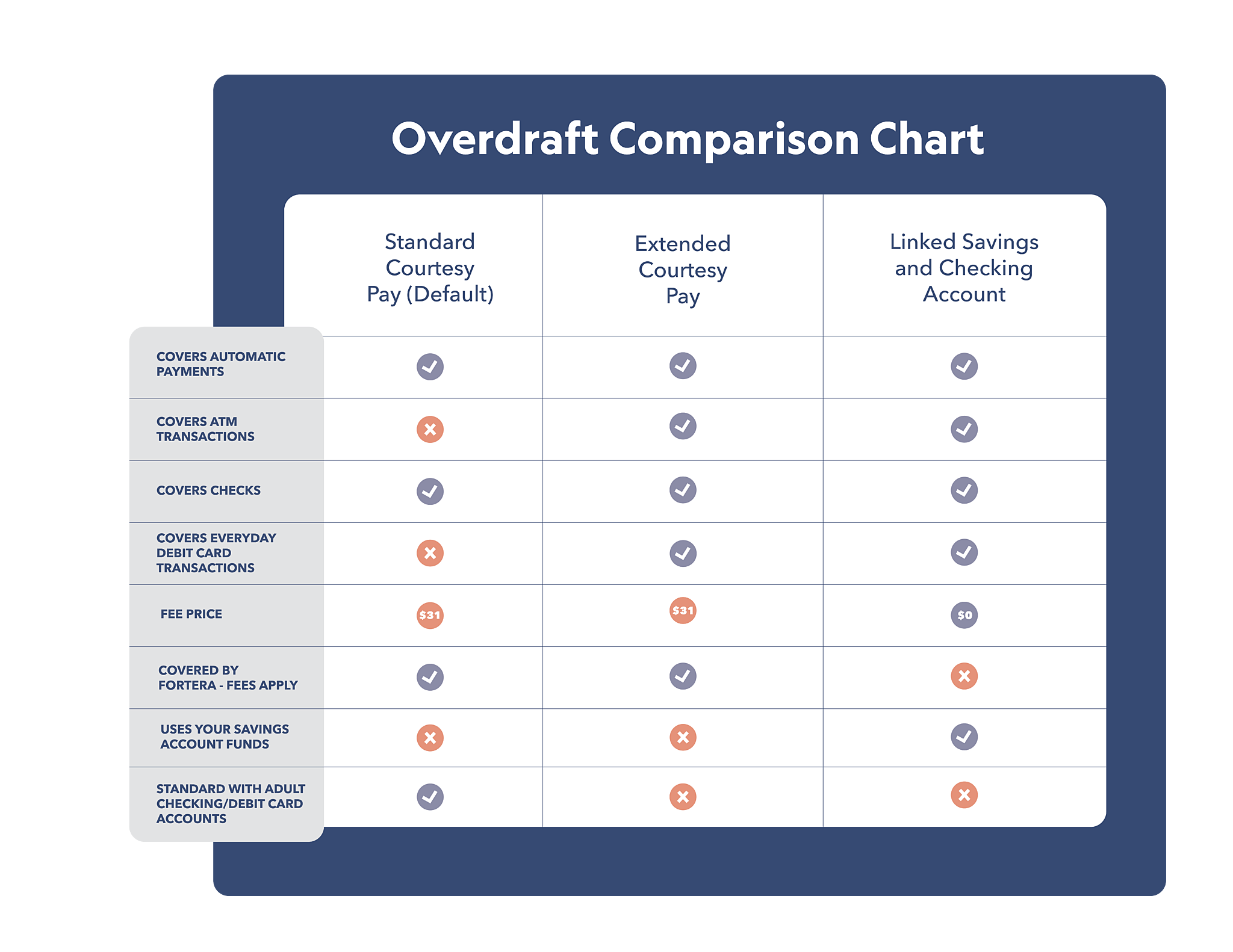

Courtesy Pay Coverage (Standard and Extended)

Courtesy Pay is an optional add-on to your checking account that can provide an additional layer of coverage. It's designed to help you avoid rejected or returned payments and unexpected card declines. Those moments can be frustrating, embarrassing, or even harmful, and we never want our members to experience that.

We offer both a standard and an extended version of this coverage, so you can tailor the types of expenses protected against overdraft. Scroll down to learn more about Courtesy Pay or linking your savings account to your checking account.

Overdraft Protection Options

Option 1: Linking Your Savings Account to Your Checking Account

Description

An easy, simple way to prevent overdrafts is to link your savings account (credit unions often refer to your savings account as a share account) to your checking account. This is a popular and easy-to-manage option that we recommend for all of our members.

Details

Linking your checking account to your savings account means that when you accidentally overdraft, we take funds from your share account to cover the accidental overspending in your checking account.

If you have sufficient funds in your share account to cover the full cost of the accidental overdraft, no fee will be charged.

Is it right for you?

We love this option for all our members, but we especially recommend it for those new to saving and spending. It provides a little added protection while you are learning to manage your money. Our favorite time to recommend this is when parents are teaching their kids how to use their debit cards for the first time, all the way through high school or college. However, any member would benefit from this, regardless of their current financial situation.

Option 2: Standard Courtesy Pay Coverage (The Default Option)

Description

This is the coverage that most of our members have, and it is automatically applied to your account upon joining. Standard Courtesy Pay Coverage is designed to help you cover checks, scheduled bills, and automated transactions. These are expenses that we have noticed are easy for members to forget, and they often need a little extra help to make sure necessary bills are paid on time.

Details

With Standard Courtesy Pay, even if you don’t have money in your account to cover the cost, you can still receive the service and pay us back at a later time. Instead of pulling the money out of your savings, we give you the cash you need to cover your overdraft expenses. Think of it like a mini loan without the added interest. This service does include a $31 fee each time you overdraft.

Is it right for you?

We recommend this service to members who have scheduled payments or bills that absolutely cannot be missed. Standard Courtesy Pay Coverage ensures that even in hectic times and when your account balance is low, we can assist you with paying essential bills.

Option 3: Extended Courtesy Pay Coverage

Description

For those who would like the most extensive coverage possible, we do offer our Extended Courtesy Pay Coverage. This coverage pairs with Standard Courtesy Pay and covers debit card and ATM transactions, in addition to the checks, scheduled bills, and automatic payments covered by Standard Courtesy Pay. It also has a $31 fee each time it is used.

Details

Unlike Standard Courtesy Pay, this coverage is not automatically applied to your account, but you can easily request it to be added. Simply speak to a member of our team to request this additional protection.

Is it right for you?

We recommend this type of coverage for members who frequently travel and may not have easy access to manage their finances, or for members who are generally more concerned about having a card declined.

Budgeting Expertise

If you want to learn how to budget more successfully each month so that overdrafts don't sneak up on you, we can help. With classes, webinars, workshops, worksheets, articles, calculators, and more, we have all the free resources you can imagine to help you feel informed and in control of your finances. You can visit our Financial Wellness page to set up your own Enrich Powered by Fortera account to get started now.

And, don't forget, we are always happy to meet in person and help you. Please schedule an appointment with your local branch today and let us help you build your financial plan.

Free Financial Wellness Tools:

FAQs

How much does Courtesy Pay cost?

The fee for using Courtesy Pay to cover an unexpected cost is $31 per transaction.

Can I remove Courtesy Pay from my account?

Absolutely. Simply reach out to our team via text or call at 931.431.6800, online or via video chat, email us at info@forteracu.com, or visit your local branch, and we will happily remove it for you.

How do I add Courtesy Pay to my Checking Account?

Standard Courtesy Pay is automatically applied to your account when you join the credit union. If you join the credit union before you turn 18, Standard Courtesy Pay is applied to your account after your 18th birthday. If you have previously elected not to have Standard Courtesy Pay, or you would like to also add Extended Courtesy Pay to your account, please reach out to us via text or call at 931.431.6800, online and video chat, or by visiting your local branch.

If you do not have the money in your savings account to cover the cost of an overdraft, Standard Courtesy Pay Coverage kicks in, and any scheduled bills, automatic payments, or checks will be covered, and you will be charged a $31 fee. If you do not have Standard Courtesy Pay Coverage on your account, the service will not be completed.

Can I add Courtesy Pay to any type of checking account?

Courtesy Pay can be applied to both our Go Checking Account and our Full Circle Checking Account. We do not allow Courtesy Pay to be applied to our Flex Checking Accounts because those account holders are under the age of 18.