How To Improve Your Credit Score

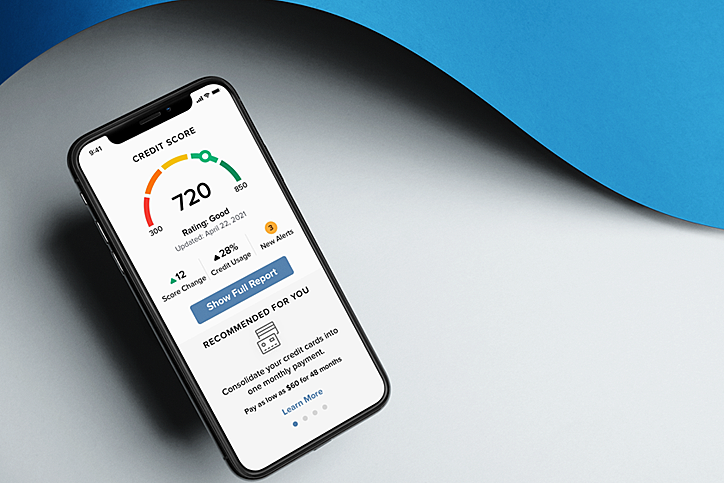

When it comes to credit scores, there’s almost always room for improvement. If you’ve pulled your score and you’re not satisfied with the number you received, there are several strategies to boost it. But first, you need a little insight into how that score is calculated.

VantageScore, the company that generates the credit score you see here, uses five major categories of information, all of which was reported to the credit bureaus by your lenders to generate scores that range from 350 to 850 (higher is better, of course). Each category is weighed differently. Here’s a breakdown:

• 40% is based on your payment history, and whether you pay on time.

• 21% is the age and type of credit you have. This percentage factors in how long you’ve had different kinds of credit accounts open. The older and more diverse (auto, mortgage, credit card) your credit is, the better.

• 23% is your credit utilization. Also known as credit usage, it’s the ratio between the total balance you owe and your total credit limit on your accounts. It’s best to keep your credit utilization below 30 percent — this is because if you are consistently maxing out your credit cards, it’ll look like you need money in the eyes of a lender.

• 11% is based on your total amount of recently reported balances on your credit accounts. You’ll want to keep your balances generally low because that’ll suggest to lenders that you are capable of making your payments on time.

• 5% is based on recent credit applications. Opening multiple credit accounts in a short period of time could represent a greater risk for lenders — multiple recent inquiries may worry lenders that you are applying to so many places because you are unable to qualify for credit — or because you need money in a pinch — so avoid opening too many accounts too quickly. (You don’t have to worry about this if you’re shopping for a mortgage or car loan. All inquiries within a 14 day period count as a single one.)

If you want to raise your score, you can do a few key things.

• Pull your credit reports. Fortera members also have instant access to their credit score and credit report. Click here to learn more about accessing your report anytime via our Online and Mobile banking. If you find an error on your report, you should dispute it. Simple mistakes – the wrong address or a misspelling of your name – can be fixed by calling the creditor and asking for an update. If they won’t oblige, or the error is more complicated, you should dispute directly with the credit bureaus. You can do this online.

• Pay your bills on time. One day late is still considered late, and just one late payment can lower your score.

• Pay down credit card debt. You don’t want to be using more than 30% of the of the total credit available to you. Keeping your utilization well below that (closer to 10%) can give your score a boost.

• Hang onto old cards. Your credit score benefits from long relationships with lenders, so cut them up, but don’t cancel them if you can help it.

• Be thoughtful about shopping for new credit. Every time you apply for a new card or loan, the lender takes a peek at your credit history, which dings your score.

• Spread your debts around. The mix of credit you have in your file—mortgages, student loans, auto loans, credit cards—shows that you can juggle debt from multiple sources.

Remember that time – and patience – are key. You shouldn’t expect a change overnight, but you will see improvement over the course of 12 to 18 months – shorter, if your score is already fairly high and you’re just looking for a bit of jump.

Article distributed in partnership with SavvyMoney with reporting by Jean Chatzky.